Christensen’s Disruptive Innovation Playbooks + Porters Five Forces

By H Griffiths: Originally Published Feb 12 2018 on Medium.com, and republished in The Startup

I recently wrote an article on the broadening use of the term disruption which led me to revisit Clayton Christensen’s classic 1997 book on disruption The Innovators Dilemma. In this book, Christensen describes two archetypal “playbooks” which detail how two different forms of disruption play out over time.

Playbook 1

The first playbook describes the sequential set of moves made by a disruptive new entrant. Christensen identified that they initially undercut the current market providers value proposition with a new low-end proposition to gain a foothold with the current providers least valuable customers (or even non-customers that the current providers have overlooked), before increasing the value of their proposition to capture the middle and eventually high-end customers.

Playbook 2

The second playbook describes what happens when an organisation in an adjacent market develops a new alternative solution to satisfy a customer’s underlying need which attracts the current market’s customers over to the new alternative solution which may exist in an adjacent or new market.

In his later work, Christensen articulated the concept of the customer’s job-to-be-done” to explain how a reevaluation of the customer’s underlying need can lead to new insights, invention and innovation which may render current solutions far less relevant or completely redundant.

The risk of overlooking Playbook 2?

I’ve noticed that in many recent articles which discuss disruption and reference Christensen’s work, most just refer to the first playbook but do not mention the second.

I suspect that this focus on one rather than both playbooks may leave organisations at a higher risk of being blindsided by alternative solution disruptions if they are not attuned to recognising when this particular playbook is being played out against their interests.

I also suspect that given the increased rate of digitally-enabled innovation that we are now experiencing across many industries, the likelihood of an organisation or market being disrupted by the second playbook rather than, or in addition to the first, is increasing.

In addition to the second playbook representing new alternative solutions for the job-to-be-done, I also suspect that we will see many existing “jobs” which industries currently solve for being eliminated completely in the not too distant future.

This new wave of value vaporisation will be brought about because the underlying need is eliminated completely. For example, will gene therapy lead to the eradication of certain diseases which will eliminate the need for a range of current treatments around which certain sectors are built?

The alignment between the Disruptive Innovation Playbooks and Porters Forces

This line of thought took me back to considering the insights which can be obtained from Michael E Porters classic five forces framework, which sought to explain the competitive intensity, and therefore the potential profitability of an industry by analysing five forces.

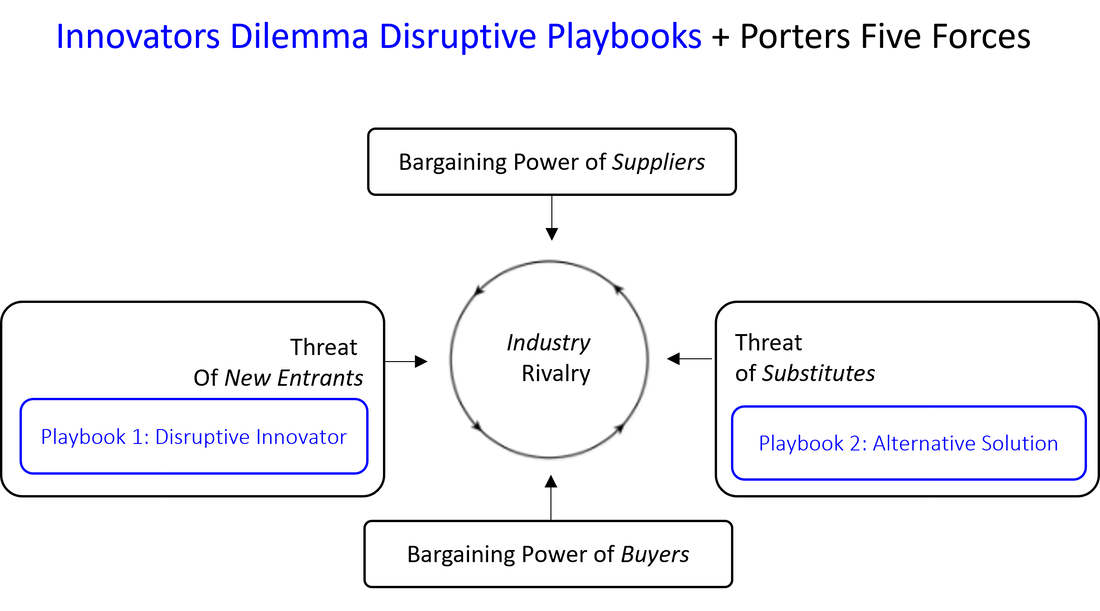

It was then that I recognised the overlap between Porters Competitor and Substitute forces and Christensen’s two playbooks which I had not noticed before which I have represented in the diagram below.

This simple illustration show’s how Christensen’s concepts of disruptive innovation can be combined with Porters Five Forces Framework to gain greater insight into the dynamics in a given industry.

In this initial version, I have shown the playbooks to be a subset of the possible types of new entrants or substitutes, as not all new entrants or substitutes which you may identify using the Five Forces Framework would be classified as disruptive using Christensen’s definitions.

I recently wrote an article on the broadening use of the term disruption which led me to revisit Clayton Christensen’s classic 1997 book on disruption The Innovators Dilemma. In this book, Christensen describes two archetypal “playbooks” which detail how two different forms of disruption play out over time.

Playbook 1

The first playbook describes the sequential set of moves made by a disruptive new entrant. Christensen identified that they initially undercut the current market providers value proposition with a new low-end proposition to gain a foothold with the current providers least valuable customers (or even non-customers that the current providers have overlooked), before increasing the value of their proposition to capture the middle and eventually high-end customers.

Playbook 2

The second playbook describes what happens when an organisation in an adjacent market develops a new alternative solution to satisfy a customer’s underlying need which attracts the current market’s customers over to the new alternative solution which may exist in an adjacent or new market.

In his later work, Christensen articulated the concept of the customer’s job-to-be-done” to explain how a reevaluation of the customer’s underlying need can lead to new insights, invention and innovation which may render current solutions far less relevant or completely redundant.

The risk of overlooking Playbook 2?

I’ve noticed that in many recent articles which discuss disruption and reference Christensen’s work, most just refer to the first playbook but do not mention the second.

I suspect that this focus on one rather than both playbooks may leave organisations at a higher risk of being blindsided by alternative solution disruptions if they are not attuned to recognising when this particular playbook is being played out against their interests.

I also suspect that given the increased rate of digitally-enabled innovation that we are now experiencing across many industries, the likelihood of an organisation or market being disrupted by the second playbook rather than, or in addition to the first, is increasing.

In addition to the second playbook representing new alternative solutions for the job-to-be-done, I also suspect that we will see many existing “jobs” which industries currently solve for being eliminated completely in the not too distant future.

This new wave of value vaporisation will be brought about because the underlying need is eliminated completely. For example, will gene therapy lead to the eradication of certain diseases which will eliminate the need for a range of current treatments around which certain sectors are built?

The alignment between the Disruptive Innovation Playbooks and Porters Forces

This line of thought took me back to considering the insights which can be obtained from Michael E Porters classic five forces framework, which sought to explain the competitive intensity, and therefore the potential profitability of an industry by analysing five forces.

It was then that I recognised the overlap between Porters Competitor and Substitute forces and Christensen’s two playbooks which I had not noticed before which I have represented in the diagram below.

This simple illustration show’s how Christensen’s concepts of disruptive innovation can be combined with Porters Five Forces Framework to gain greater insight into the dynamics in a given industry.

In this initial version, I have shown the playbooks to be a subset of the possible types of new entrants or substitutes, as not all new entrants or substitutes which you may identify using the Five Forces Framework would be classified as disruptive using Christensen’s definitions.

(black text/box diagram copied from Wikipedia — see source reference below. Blue text boxes added by this author)

Conclusion

For those who are used to using either Porter’s Five Forces framework or Christensen’s Innovators Dilemma insights, you may gain greater insights if you combine the two.

References:

Conclusion

For those who are used to using either Porter’s Five Forces framework or Christensen’s Innovators Dilemma insights, you may gain greater insights if you combine the two.

References:

- Porters Five Forces — Wikipedia entry

- Clayton Christensen’s Innovators Dilemma. ISBN-10: 1633691780